OK, folks, here’s what we’re asking you to do. First, save as much money as you can while you’re working, despite ongoing expenses. Next, figure out how to invest the money and, once you’ve gained critical mass on your savings, determine if it’s going to be enough. Is it any wonder so many pre-retirees are overwhelmed by retirement planning?

However, there is good news, as well. Some of the key success factors that have the power to make or break a retirement plan can be simple if understood correctly. While investors don’t need to hit the mark on every last one of them, handling the majority of them correctly increases the chances of a successful retirement plan.

Success Factor 1: A Flexible Retirement Date. For investors who analyzed the numbers on their retirement plans and found that their nest egg could come up short, one option to consider is working longer. Doing so can be advantageous on a few different levels. Investors will have more years to save and fewer years to draw from their portfolios. They may also be able to defer Social Security, which can be profitable, especially for people with a longer-than-average life expectancy. Another option to consider is a hybrid strategy, shifting into a lower-paid, but more rewarding and/or less stressful, career. Alternatively, investors could stay put in their current positions but spend (rather than bank) additional retirement-plan contributions. Such a strategy could allow some people to pay for retirement dreams, such as exotic travel, while still working. Additional retirement-plan contributions in your 60s benefit less from tax-deferred compounding than do contributions made earlier on. Of course, working longer isn’t always a possibility: Health considerations (for oneself, a spouse, or a parent) may interfere, or aging employees may not be able to hang on to their jobs. That’s why working longer can’t be the only fallback plan; investors need to make sure they have other success factors working in their favor, too.

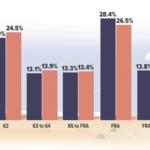

Success Factor 2: A Well-Considered Social Security Strategy. Deciding when to file for Social Security is one of the most consequential financial decisions most Americans will make about their retirement. The 1980s and 1990s were all about maximizing portfolio returns. But the specter of twin bear markets in the 2000s, as well as ultra-low interest rates, shone a light on more mundane matters, including trying to get the most out of Social Security. Even casual students of Social Security planning have heard the admonition to not take Social Security at age 62, when they’re first eligible, as doing so will result in a permanent cut to benefits. And for people who have longevity on their side, it may be better to delay benefits for as long as possible, because benefits increase for every year from full retirement age until age 70. Keeping those rules of thumb in mind is a great first step toward getting a Social Security plan moving in the right direction, but retirement planners can also take advantage of more sophisticated strategies, especially if they’re part of a married couple. More and more financial planners are focusing on Social Security maximization, and there are also a number of online tools that can help craft a prudent Social Security plan.

Success Factor 3: A Large Enough Stock Allocation. The traditional lifetime glide path calls for accumulators to hold very high weightings in stocks, and then gradually peel back equity exposure as the years go by. But make no mistake: Pre-retirees and retirees may need plenty of stocks, too. The key reason is purchasing-power preservation. If inflation runs at 3%, it’s hard to see how a portfolio of nominal bonds and cash yielding 2% to 3% is going to be able to hold up. Of course, there are other ways to hedge inflation risk, but stocks are the asset class with the highest probability of out-earning inflation over time. That argues for most retirees holding at least half of their assets in stocks coming into retirement.

©2015 Morningstar, Inc.