Ten Trading Commandments

Respect the price action but never defer to it. Our eyes are valuable tools when trading but if we deferred to the flickering ticks, stocks would be “better” up and “worse” down and that’s a losing...

Read Moreby Gene G. Smith, CPA Smith, CPA | Aug 10, 2011 | Investment Planning, Market Trends | 0

Respect the price action but never defer to it. Our eyes are valuable tools when trading but if we deferred to the flickering ticks, stocks would be “better” up and “worse” down and that’s a losing...

Read Moreby Gene G. Smith, CPA Smith, CPA | Jun 6, 2011 | Retirement Planning | 0

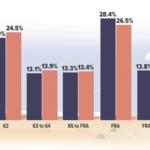

So you set up your retirement plan say ten or 15 years ago, it’s time for a checkup! The sooner you can make adjustments the better, especially if you are going to have to make some big changes in your plan. One...

Read More